Further EV adoption and public charging stations are becoming more and more important.

While home charging presently meets the majority of the demand for charging, public chargers are becoming more and more necessary to offer the same degree of convenience and accessibility as for refilling traditional automobiles. Public charging infrastructure is a crucial enabler for EV adoption, particularly in congested metropolitan settings where access to home charging is more constrained. More than 900,000 public charging stations were installed in 2022, adding to the global total of 2.7 million by the year’s conclusion. This represents a 55% increase from the stock at the beginning of 2021 and is comparable to the pre-pandemic growth rate of 50% between 2015 and 2019.

Slow Chargers

In 2022, more than 600 000 public slow charging points1 were installed around the world, 360 000 of which were in China, increasing the total number of slow charging stations there to over 1 million. By the end of 2022, more over half of the world’s public slow chargers were located in China.

With 460 000 slow chargers overall in 2022, an increase of 50% from the previous year, Europe comes in second. With 117 000, the Netherlands has the most residents in Europe, followed by roughly 74 000 in France and 64 000 in Germany. The United States saw the slowest rise in the stock of slow chargers in 2022, rising by only 9%. Slow charging supply in Korea has increased by 50% year over year to 184 000 charging points.

Fast Chargers

Longer trips are made possible and range anxiety, a barrier to EV adoption, can be alleviated by readily available fast chargers in public places, particularly those along highways. Public fast chargers, like slow chargers, offer charging options to customers who lack dependable access to private charging, promoting EV adoption among a wider range of the populace. Globally, there were 330 000 more fast chargers installed in 2022, however China once more accounted for the vast bulk (almost 90%) of the rise. Fast charging deployment meets China’s objectives for rapid EV deployment and makes up for the lack of access to home chargers in densely populated cities.

.

By the end of 2022, there were over 70 000 fast chargers in Europe, an increase of almost 55% from 2021. Germany (almost 12 000), France (9 700), and Norway (9 000) have the most fast chargers on hand. The provisional agreement on the proposed Alternative Fuels Infrastructure Regulation (AFIR), which will establish requirements for the coverage of electric charging infrastructure throughout the trans-European network-transport (TEN-T), demonstrates that there is a clear desire within the European Union to advance the public charging infrastructure. More than EUR 1.5 billion will be made available by the end of 2023 for alternative fuels infrastructure, including electric fast charging, thanks to a deal between the European Investment Bank and the European Commission.

In 2022, the US added 6 300 fast chargers, of which around 35% were Tesla Superchargers. At the end of 2022, there were 28 000 fast chargers available overall. After the National Electric Vehicle Infrastructure Formula Programme (NEVI) was approved by the government, deployment is anticipated to pick up speed in the upcoming years. Participating in the plan are all 50 US states, Washington, DC, and Puerto Rico. Funding of USD 885 million has already been earmarked for the programme through 2023 to enable the installation of chargers along 122 000 km of highway (see Policy support for EV charging infrastructure). To guarantee uniformity, dependability, accessibility, and compatibility, the US government Highway Administration has set new national requirements for EV chargers that receive government funding.

Electric LDV to public charger ratio

For EV adoption to become widely accepted, public charging infrastructure must be set up in advance of an increase in EV sales. For instance, Norway had about 1.3 battery-powered LDVs per public charging station in 2011, which encouraged future adoption. By the end of 2022, Norway will have 25 BEVs per public charging station, with over 17% of LDVs being BEVs. The charging point per BEV ratio typically lowers as the stock proportion of battery electric LDVs rises. Sales growth for EVs can only be maintained provided infrastructure is available and reasonably priced to meet the demand for charging, either through private charging at home or at work or publicly accessible charging stations.

Although PHEVs are less dependent on public charging infrastructure than BEVs are, policy-making on the adequate availability of charging outlets should take public PHEV charging into consideration (and encourage it). The global average in 2022 was roughly ten EVs per charger, if the entire number of electric LDVs per charging point is taken into account. Less than ten EVs per charger have been maintained over the years in nations like China, Korea, and the Netherlands. The number of publicly accessible chargers has been increasing at a rate that largely equals EV deployment in nations that rely significantly on public charging.

The number of EVs per public charging point, however, can be even higher in some markets with extensive availability of home charging (owing to a high share of single-family houses with the option to install a charger). For instance, the number of EVs per charger in the United States is 24, but it is over 30 in Norway. Public charging becomes more crucial, even in these nations, as the market share of EVs grows, to encourage drivers who lack access to private home or office charging options to choose EVs. The ideal number of EVs per charger will fluctuate depending on regional factors and driver preferences.

Given that fast chargers can accommodate more EVs than slow chargers, the overall public charging power capacity per EV may be more significant than the quantity of available public chargers. It makes sense for the available charging power per EV to be high in the early phases of EV adoption, assuming that charger utilisation will remain relatively low until the industry reaches maturity and the utilisation of infrastructure becomes more efficient. Accordingly, the interim agreement between the European Union and the AFIR specifies that the entire power capacity must be given based on the size of the registered fleet.

Around 2.4 kW per EV are used as the typical public charging power capacity for electric LDVs worldwide. The ratio is lower in the European Union, with an average of about 1.2 kW per EV. In spite of the fact that 90% of public chargers in Korea are slow chargers, the country has the highest ratio at 7 kW per EV.

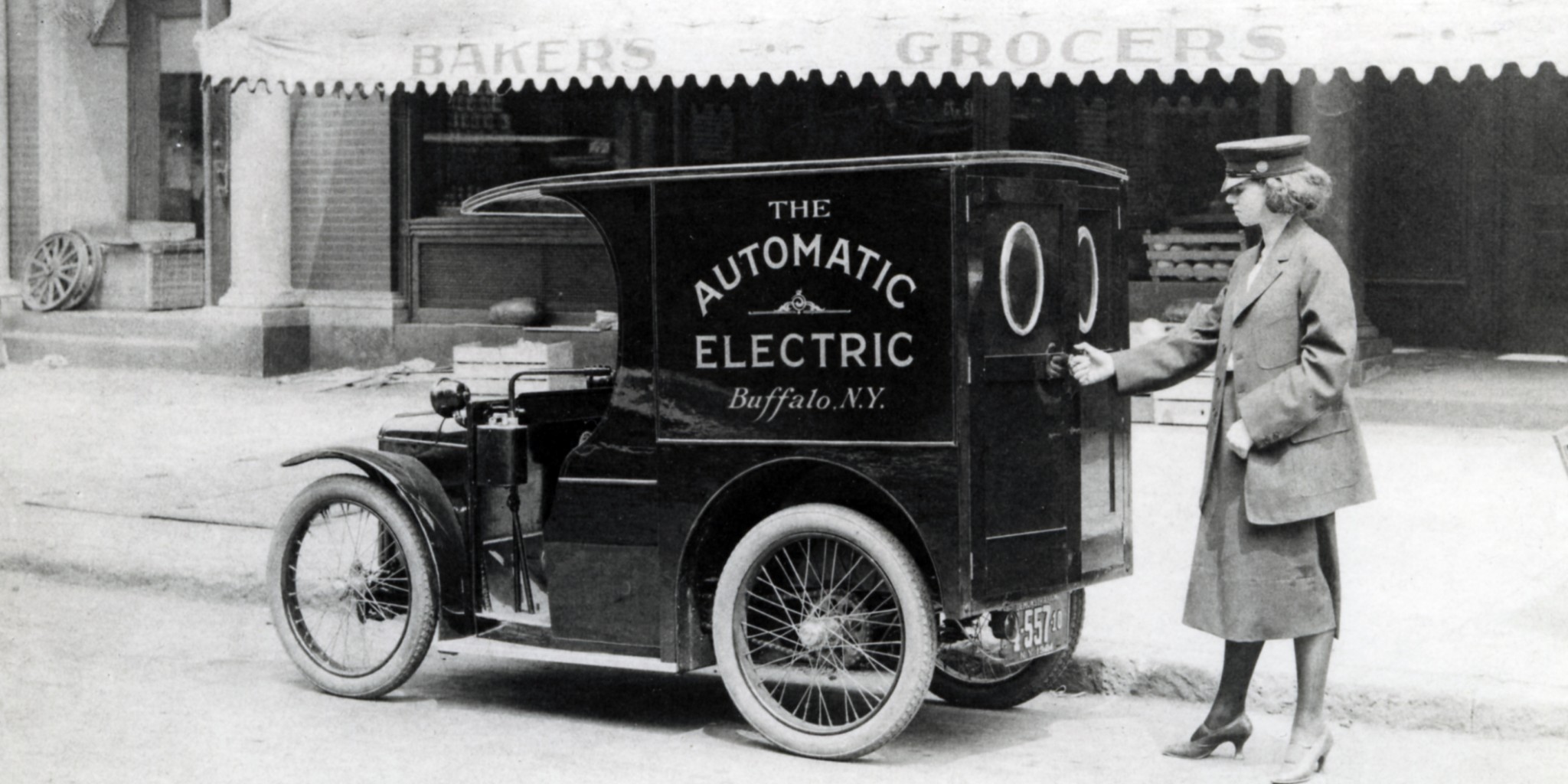

Changing the battery on two- and three-wheelers can save money.

According to studies by the International Council on Clean Transportation (ICCT), battery swapping for electric two-wheelers in taxi services (such as bike taxis) provides the most affordable total cost of ownership (TCO) when compared to point charging BEV or ICE two-wheelers. Point charging currently offers a lower TCO than battery switching for last-mile deliveries using a two-wheeler, but under specific circumstances swapping could be an effective solution with the correct legislative incentives and scale. In general, battery electric two-wheelers with battery swapping become more inexpensive than point charging or petrol vehicles as the average daily distance travelled grows. The Swappable Batteries Motorcycle Consortium was established in 2021 with the purpose of making battery changing easier for light-weight vehicles, particularly two- and three-wheelers.

China is a pioneer in truck battery-changing

Battery changing, as opposed to ultra-fast charging, can have significant advantages for vehicles in particular. First off, switching can be completed in as little as 3-5 minutes, which is much quicker than cable-based charging, which calls for an ultra-fast charger connected to medium- to high-voltage grids as well as pricey battery management systems and chemistries. Extending battery capacity, performance, and cycle life can all be achieved by avoiding ultra-fast charging.

By separating the purchase of the truck and the battery and creating a lease agreement for the battery, battery-as-a-service (BaaS) significantly lowers the initial purchase cost (by as much as 50%). Trucks are also ideal for battery swaps because they typically use lithium iron phosphate (LFP) chemistries, which are more robust than lithium nickel manganese cobalt oxide (NMC) batteries.

However, given the greater vehicle size and heavier batteries, which require more space and specialist equipment to conduct the swap, the cost of creating a station will probably be higher for switching out truck batteries. The need that batteries be standardised to a specific size and capacity is another significant hurdle. Truck OEMs are likely to view this requirement as a hindrance to their ability to compete because battery design and capacity is a key point of differentiation among electric truck manufacturers.